Individual investors invested in Daimler Truck Holding AG (ETR:DTG) copped the brunt of last week’s €613m market cap decline

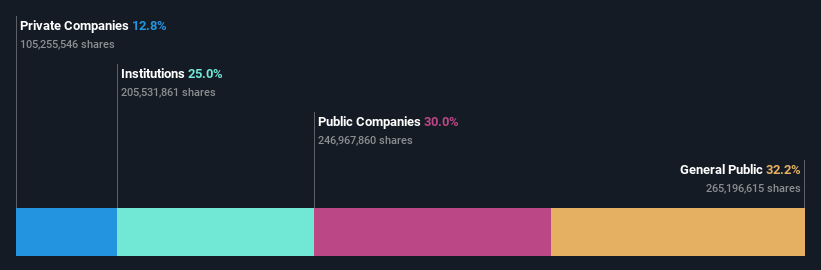

Every investor in Daimler Truck Holding AG ETR:DTG should be aware of the most powerful shareholder group. Individual investors hold 32% of the company’s shares. This means that the group is most likely to gain from a stock increase, or lose it if it falls.

Individual investors suffered the greatest losses last week, when share prices plunged 3.1%.

Let’s take a closer glance to learn more about Daimler Truck Holdings from the different shareholders.

If you don’t want to research DTG’s ownership structures, we have a Free Here are some interesting ideas for investing that might inspire you to make your next investment.

What does the Institutional Ownership tell us about Daimler Truck Holdings?

When reporting to their investors, institutions often measure themselves against a benchmark. This is why they are more likely to be enthusiastic about a stock once it is included in a major index. We expect most companies to have at least one institution on the register, especially if their businesses are growing.

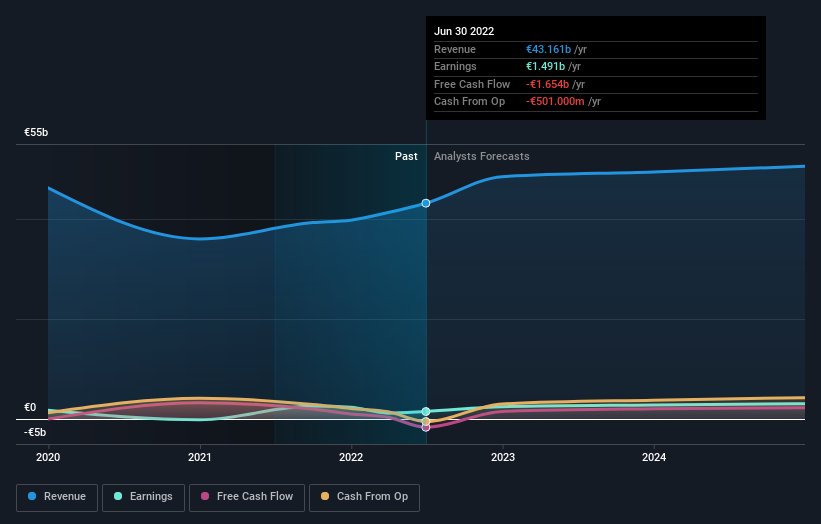

As you can see institutional investors own a significant amount of Daimler Truck Holding. This suggests that analysts working for these institutions have examined the stock and found it appealing. They could be wrong just like everyone else. If multiple institutions have different views on a stock, the share price can drop quickly. You might also want to look at Daimler Truck Holding’s earnings history. The future is what matters most.

Hedge funds do not own Daimler Truck Holding. Mercedes-Benz Group AG is the company’s largest shareholder, holding 30% of outstanding shares. Beijing Automotive Group Co.,Ltd, which holds 6.5% of the common stock, is the second largest shareholder. Tenaciou3 Prospect Investment Limited, which holds 6.3%, is the third largest shareholder.

Our research also revealed that 53% of the company’s shares are owned by the top five shareholders, suggesting that they have significant influence over the business.

Although institutional ownership can be a valuable addition to your research, it’s also a good idea to research analyst recommendations to gain a deeper understanding of a stock’s expected performance. Many analysts cover the stock so you can easily look into forecast growth.

Insider Ownership Of Daimler Truck Holding

Although the exact definition of insider is subjective, most people consider board members insiders. The shareholders’ interests should be represented by the answers of the company management to the board. Notably top-ranking managers may be members of the board.

Insider ownership is considered a positive sign that the board is aligned with other shareholders. There are times when too much power is concentrated within this group.

Our data can’t confirm that board members own shares personally. Different jurisdictions have different rules regarding disclosing insider ownership. It is possible that we have missed something. You can click here to find out more about the CEO.

General Public Ownership

A 32% share of Daimler Truck Holding is owned by the general public. These are usually individual investors. Even though this is a significant ownership stake, it may not be enough for the company to change its policy if the decision does not align with other large shareholders.

Private company ownership

Our data shows that 13% of company shares are owned by private companies. It is difficult to draw any conclusions based on this data alone. Therefore, it is worth investigating who owns these private companies. Sometimes insiders or related parties may have a share in shares of a public company through another private company.

Public Company Ownership

We believe that 30% of Daimler Truck Holdings is owned by public companies. While we cannot be certain, it is possible that this is a strategic stake. These businesses could be related or work together.

Next steps:

It is always worth considering the different ownership groups of shares in a company. Daimler Truck Holding can be understood better if we consider other factors. Take risks as an example. We’ve seen them in every company. 1 warning sign for Daimler Truck Holdings You should be aware of these things.

If you are like me you may be interested in whether the company will grow. You can get a free report that shows forecasts from analysts for the company’s future.

NB. The figures in this article are based on data from the 12 months ending on the date of the financial statements. This may not be consistent to full-year annual report figures.

Valuation is complicated, but we can help make it simple.

Find out if Daimler Truck Holding Our comprehensive analysis will reveal whether your potential over- or undervalued. Fair value estimates, risk and warnings. Dividends. Insider transactions. Financial health.

Get a Free Analysis

Give feedback on this article Are you concerned about its content? Get in touch Contact us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article is by Simply Wall St. It is general in nature. Our commentary is based only on historical data, analyst forecasts, and we do not provide financial advice. It does not make a recommendation to buy, sell, or trade any stock. It also does not consider your financial goals or financial situation. We are committed to providing you with long-term focused analysis that is based on fundamental data. Please note that our analysis may not include the most recent announcements from price-sensitive companies or qualitative material. Simply Wall St holds no position in any stocks.