What were the 3D Printing Trends for 2022?

As 2022 comes to an end, it’s time once again to reflect upon the state of the 3D printing market this year. It is also the time to reflect on the trends that dominated additive manufacturing. This year, it was evident that the AM sector is making the same progress as previous years. It has continued to recover from the Pandemic, as well as continue industrialization, moving mainly towards large-format 3D printers and larger-scale operations. The field’s actors continue to be concerned about sustainability.

It is not difficult to see the connection between sustainability and 3D printed objects. AM is often praised for its ability to reduce waste. It is not perfect. Plastic use is a matter of controversy. However, 3D printing has made it easier to focus on the development of the technologies and encourage environmental responsibility. The Additive Manufacturer Green Trade Association, (AMGTA), continues to grow and includes many leaders in additive manufacturing. The association currently has 50 members, which is a significant increase since the beginning of 2021.

Sherri Monroe is the Executive Director of the AMGTA, an association which has grown rapidly as interest in 3D printing’s role in more sustainable manufacturing is explored (photo credits: 3Dnatives)

However, we also noticed a lot of new trends in the sector. But what are these new trends? What has changed in the past year? What do we see for AM in the near future To close the year, we took some time to look back at the key takeaways from 2022’s 3D printing sector.

Consolidation takes the center stage for 3D Printing in 2022

We reviewed a report at the beginning of the year that indicated that 3D printing would not consolidate in the near future. But, this was quickly proved wrong. Despite the industry’s growth in 2022, there were many signs of consolidation in the 3D printer sector. These included mergers and acquisitions, as well as partnerships.

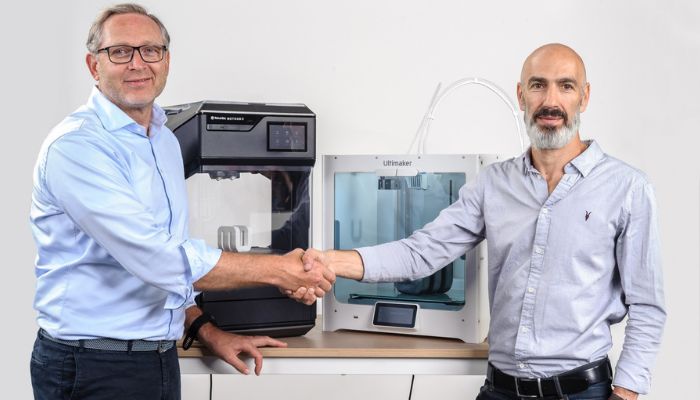

The merger between Ultimaker & Makerbot in May 2022 was perhaps the biggest consolidation shock of the year. For those who have been around 3D printing for a while, MakerBot was among the first 3D printer companies to emerge out of the RepRap movement. It was actually acquired by Stratasys in 2013. Ultimaker is a well-known brand on the market for its desktop solutions, but also for its Cura software, which is a well-known slicer among 3D printing enthusiasts.

Juergen von Hallen (right) and NadavGoshen (left), embracing each other at the closing of the merger. Photo credit: Ultimaker

In September, the merger was completed. UltiMaker was launched as a new brand. Both companies stressed the importance of the merger to them. “fueling global 3D printing innovation”, namely by combining their current strengths and solutions as well as investing in new R&D for more products. In a press release, Nadav Goshen (ex-CEO of Makerbot) commented on the merger. “As we begin the next chapter together as UltiMaker, we will continue to focus on developing 3D printing innovations to advance the availability of accessible and easy-to-use 3D printing solutions. By combining our teams and technical expertise, we can work towards developing and delivering a comprehensive portfolio of products to support professional, educational and light-industrial applications.”

This is just one example. 3D Systems announced in February, that after having sold various parts of its company, it would be purchasing Titan Robotics (and Kumovis) and returning to the FDM marketplace after a long absence. The company also wanted to acquire dp polar GmbH (a German manufacturer of an AM system that can be mass produced at high speeds and customized components).

Similarly in August, Stratasys, one of the leading and first 3D printing manufacturers, announced its acquisition of Covestro’s 3D printing material business. Carbon also acquired ParaMatters, a software firm known for its generative design capabilities. This is where you might start to see a pattern in many mergers and acquisitions that have taken place over the years. We noticed that AM companies are looking to create complete end-to-end solutions to additive manufacturing by targeting companies with different strengths (e.g. software or materials).

Markforged will be entering the metal binder-jetting market with the acquisition of Digital Metal (photo credits to Digital Metal).

This can also be seen More companies were looking for access to other AM technologies in order to expand their business reach. Markforged, which acquired Digital Metal to expand its reach in the metal binder jetting industry, is a notable example. Markforged is well-known for its 3D metal printing and carbon-fiber products. It has experienced rapid growth. Its recent move into metal binding jetting demonstrates its determination to grow, as well as placing it in direct competition on the American market with Desktop Metal.

It’s not only AM companies who are making moves to acquire and merge. We have seen large tech companies that were not as active in the sector acquire 3D printing companies this year. Nikon, a well-known camera manufacturer, decided to acquire SLM solutions via a Public Takeover offer, which was announced in September. Nikon had officially acquired 92.38% SLM as of the end of the acceptance period. SyBridge also bought the struggling Fast Radius. It went public in 2012, but quickly experienced a decline in performance. Technologies in a $15.9million sale process under the US Bankruptcy Code.

Consolidation doesn’t just mean acquisitions. However, they were abundant in 2022. We also want to emphasize the growing role of partnerships in additive production as part of this trend. Notably between software, post-processing and 3D printer manufacturers as a way to provide customers with a “one stop shop” for their 3D printing needs, helping in the continued industrialization of AM.

Software is important when you look at the many acquisitions of partnerships in AM sector over the period of 2022 (photo credit: 3Dnatives).

Discussing for example the cooperation between AMT and HP, wherein automation and software partnerships are keys to developing a fully comprehensive solution for customers, Wayne Davey, Global Head of Sales and Go To Market for HP’s Personalization and 3D printing business, commented, “We are excited to take our partnership to the next level with AMT given their shared vision, shared customer, and proven portfolio of post processing post processing technology. At HP we believe leveraging partnerships that bring unique expertise to the end-to-end Multi Jet Fusion workflow are key to accelerating the scale of additive manufacturing to production.”

DyeMansion, a well-known provider of post-processing solutions and Nexa3D, have also entered into a partnership. Kevin McAlea is the Chief Operating Officer of Nexa3D. “It’s only natural that we would partner with DyeMansion, a leading provider of automated post-processing solutions for powder bed fusion, to ensure that our industrial customers can leverage high-throughput manufacturing capabilities from end-to-end as well as reduce their total cost of operation.” It seems that 3D printing industry professionals are realizing that we are stronger together, which makes consolidation a more likely reality.

Despite growth, disruptions to the market

However, disruption can often be seen where there is growth and consolidation. Disruption was a key trend on the market since the beginning of 2022 for many reasons. One of the most important was the war in Ukraine. After months of increasing aggression from the Russian government, the Russian Invasion officially began on February 24, 2022. This move was a culmination of years of tensions between nations since the annexation and occupation of Crimea in 2014.

This may seem far removed from 3D printing, but the whole additive manufacturing community reacted to this news. Many prominent figures in the industry took action to condemn the invasion within minutes. EOS was one of the 3D printing companies that decided to cease business with Russian customers. Others organized donations.

Even though we have heard about the crisis Most of the support came in the first half of the year. However, it was continued throughout. We can point out silent auctions that were held by the Together We Are Strong initiative, which was started by companies like Nexa3D and EOS, BigRep. It was powered by ASTM International. SYGNIS. Digital University and 3YOURMIND. These were held at major 3D printing events such as Rapid + TCT 2022 or Formnext.

Companies like Sygnis, which is based in Poland, used 3D printing to aid the war effort (photo credit: Sygnis).

There were other ways in which the 3D printing community supported Ukrainians. 3D printing was made possible by users from all over the world and companies. One example is the creation and distribution of open-source tourniquets that could be used for civilians who have been injured. Companies such as Unlimited Tomorrow and Oxford Performance Materials want to send prosthetics 3D printed to the war-torn nation. Ukrainian organizations dedicated to using additive manufacturing for their country also rose up, including 3D Printing Ukraine. In this instance, the disruption occurred outside of the AM community that rose to meet it. However, this was not always the truth.

In 2022, supply chain disruptions were a major concern. While 3D printing is often an option to address these issues, the COVID crisis was a prime example of this. Plastic and microchip shortages around the world affected nearly every industry. This was made worse by the Ukrainian War, which saw trade routes rewritten almost immediately and critical materials not being able to reach their destinations.

Last but not the least, although we have seen significant growth over the past few decades in the AM sector, not all signs have been so positive. The number of layoffs that occurred over the past year is one of the most alarming signs. Although this may be partially due to market consolidation, it is also indicative of a continuing trend in the tech sector as a result the current global recession. Many of the largest companies in this industry were affected. Desktop Metal, Nexa3D and Carbon all announced they were letting go significant parts of their workforce. DM alone saw a 12% reduction in its global workforce.

Discussing the reduction, which was named a cost optimization measure, Ric Fulop, CEO of Desktop Metal, noted, “We have been focusing on finding ways to optimize our expense structure and maintain our growth opportunities, as outlined in previous financial results calls. We believe this initiative, which builds on steps we began to take in the second half of 2021 to integrate our teams, positions Desktop Metal to meet our near- and long-term financial commitments and supports our path to profitability.” This shows that profits might have been less desirable for some in the industry than they expected.

Automation and software will gain importance in 3D printing by 2022

It’s not surprising that automation is on this list. As 3D printing becomes more industrialized, automation is becoming an increasingly important requirement to enable large-scale printing in many industries. This year, we saw many different technologies and software emerge to meet this need.

We have already spoken about it when we spoke of consolidation. One sign of increased importance was the formation of partnerships between 3D printing solution providers and software providers. It was evident in post-processing. Although it is less well-known than other steps in additive manufacturing, post-processing (or the treatment of a part following printing) is crucial for the production and maintenance of high-quality parts. However the step remains time-consuming and difficult, as also shown in PostProcess’s latest report on trends in post-processing. Automation could be a solution to this problem, and that is what the industry seems to be doing, as can be seen in the recent partnerships between AMT, HP, DyeMansion, and Nexa3D.

Post-processing isn’t the only area in which automation has been emphasized in AM. As monitoring becomes a critical requirement for the creation and maintenance of end-use parts, software is becoming more important in this field. Many have invested more in creating their own software solutions that allow for an end-to-end AM workflow, or partnering with software providers to increase automation.

Markforged is a company that has been developing The Digital Forge Platform, a platform for solving their problems. This year Markforged enabled the integration of simulation software in The Digital Forge. Shai Terem, president and CEO of Markforged especially understands the need for the further integration into 3D printing operations, stating: “Simulation allows our customers adopt The Digital Forge more deeply into their manufacturing operations. This is done by replacing mission-critical tooling with validated, optimized 3D printed advanced composite pieces with Continuous Fiber Reinforcement. Cloud-based software innovation like Simulation is core to our mission to bring industrial part production to the point of need.” This demonstrates the importance of automation and software when scaling production.

AI has also continued its solidification in the 3D printing industry, especially when it is about automation. More companies are using machine learning and AI-based technology to improve processes like monitoring. Researchers are also using it to improve productivity in AM.

A recent collaboration between Fraunhofer Research Institution for Additive Manufacturing Technologies, Fraunhofer Institute for Ceramic Technologies and Systems and Fraunhofer Institute for Toxicology and Experimental Medicine is a notable example. These institutions turned to AI, 3D printing, and other technologies to create custom finger implants. This project is only the beginning. It shows the incredible possibilities that 3D printing can bring to 3D printing when it is combined with AI, software, and automation.

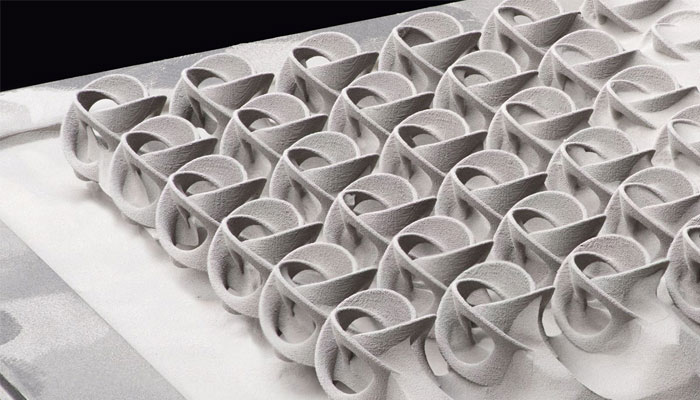

The Rise of Binder Jetting

Last but not least, we wouldn’t be remiss if one particular 3D printing technology was not mentioned in 2022. Binder jetting. Binder jetting, while not the most talked about 3D printing technology, seemed to be gaining momentum this year. It has been recognized by new compatible materials and actors in the field as one of the top 3D printing trends for 2022.

Photo credit: Digital Metal

First, material development was essential for binder jetting 2022. Desktop Metal is notable for its wide range of materials. Though of course the company continued to invest heavily in both metal and sand, two of the most common binder jetting materials, with the launch of ExOne’s S-Max Flex Sand 3D printer especially, it also branched out. The company has also invested in non-traditional materials such as wood binder jetting and rubber, as well as foam. This has allowed it expand into more industries and applications. It has also firmly established the role of binder jelly for end-use components as well as cores or molds.

Next, the binder-jetting market was the market that seemed to have changed the most this year. The binder jetting market saw a significant decline after the acquisition of ExOne last year by Desktop Metal. This was because two of its biggest competitors joined forces. We have mentioned before that there are new players. Markforged is one of them.

The American manufacturer’s acquisition of Digital Metal has placed it firmly in the metal binder jetting market as well as positioned it as a direct competitor to DM in a number of fields. But that’s not all! This year also marks the official launch of HP’s long-awaited metal 3D printing solution. HP’s Multi Jet Fusion (MJF), process is still used for its polymer solutions. However, the new metal 3D printing solution uses metal binder jetting. The Metal Jet S100 machine, which was unveiled at IMTS 222, was also showcased at Formnext.

Both Markforged and HP decided to explore metal binder jetting because it was possible to mass produce end-use metal parts. Ramon Pastor, global head and general manager of 3D Metals, HP Inc explained it thusly: “Since announcing the breakthrough Metal Jet technology in 2018, we have been working to develop the industry’s most advanced commercial solution for 3D metals mass production. 3D printed metal parts are a key driving force behind digital transformation and the new Metal Jet S100 Solution provides a world class metals offering for our customers, from the first designs right through to production, but more importantly helps them to realize the unlimited potential for digital manufacturing.”

There you have it. Although we have seen several ongoing trends in additive manufacturing, this year saw some notable new developments. Between increasing consolidation, disruption in the sector, automation’s increasing role and of course the advancements in binder jetting, 2022 was certainly not a dull one. We cannot wait to see what the future holds for 3D printing in 2023.

What do you think the 3D printing trends for 2022? Can you think of other 3D printing trends? What do you think the future holds for additive manufacturing? Let us know in a comment below or on our Linkedin, Facebook, and Twitter pages! Don’t forget to sign up for our free weekly Newsletter here, the latest 3D printing news straight to your inbox! You can also find all our videos on our YouTube channel.

*Cover Photo Credits: 3Dnatives