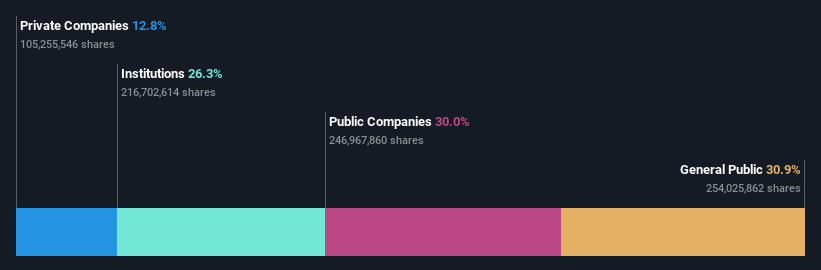

Daimler Truck Holding AG (ETR:DTG) inventory hottest amongst particular person traders who personal 31%, whereas public corporations maintain 30%

Each investor in Daimler Truck Holding AG (ETR:DTG) ought to concentrate on probably the most highly effective shareholder teams. With 31% stake, particular person traders possess the utmost shares within the firm. That’s, the group stands to profit probably the most if the inventory rises (or lose probably the most if there’s a downturn).

And public corporations then again have a 30% possession within the firm.

Let’s delve deeper into every sort of proprietor of Daimler Truck Holding, starting with the chart beneath.

Try our newest evaluation for Daimler Truck Holding

What Does The Institutional Possession Inform Us About Daimler Truck Holding?

Many establishments measure their efficiency towards an index that approximates the native market. In order that they normally pay extra consideration to corporations which might be included in main indices.

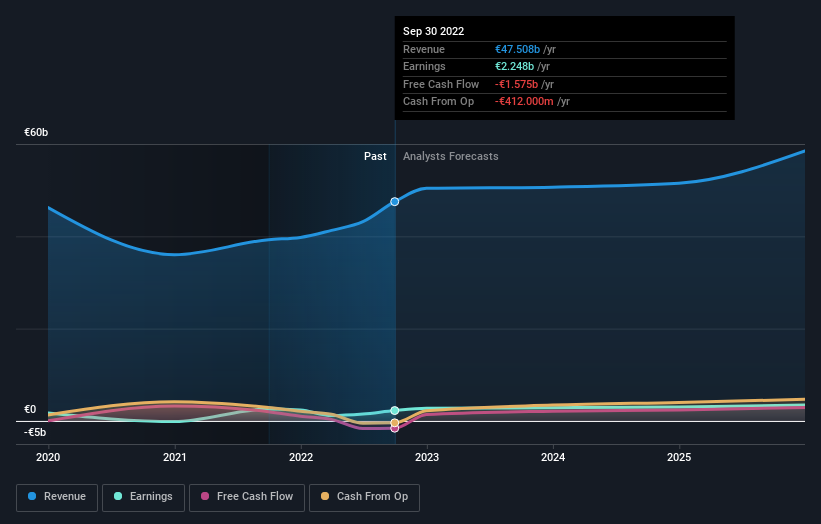

As you’ll be able to see, institutional traders have a good quantity of stake in Daimler Truck Holding. This could point out that the corporate has a sure diploma of credibility within the funding group. Nonetheless, it’s best to be cautious of counting on the supposed validation that comes with institutional traders. They too, get it unsuitable typically. It’s not unusual to see an enormous share worth drop if two massive institutional traders attempt to promote out of a inventory on the similar time. So it’s price checking the previous earnings trajectory of Daimler Truck Holding, (beneath). After all, needless to say there are different elements to contemplate, too.

Hedge funds haven’t got many shares in Daimler Truck Holding. Our knowledge exhibits that Mercedes-Benz Group AG is the most important shareholder with 30% of shares excellent. Beijing Automotive Group Co.,Ltd is the second largest shareholder proudly owning 6.5% of widespread inventory, and Tenaciou3 Prospect Funding Restricted holds about 6.3% of the corporate inventory.

On wanting additional, we discovered that 51% of the shares are owned by the highest 5 shareholders. In different phrases, these shareholders have a significant say within the choices of the corporate.

Researching institutional possession is an effective option to gauge and filter a inventory’s anticipated efficiency. The identical might be achieved by finding out analyst sentiments. There are many analysts protecting the inventory, so it may be price seeing what they’re forecasting, too.

Insider Possession Of Daimler Truck Holding

The definition of an insider can differ barely between totally different nations, however members of the board of administrators all the time depend. Administration finally solutions to the board. Nonetheless, it’s not unusual for managers to be government board members, particularly if they’re a founder or the CEO.

Insider possession is optimistic when it indicators management are considering just like the true house owners of the corporate. Nonetheless, excessive insider possession may give immense energy to a small group inside the firm. This may be unfavorable in some circumstances.

We word our knowledge doesn’t present any board members holding shares, personally. It’s uncommon to not have a minimum of some private holdings by board members, so our knowledge may be flawed. An excellent subsequent step could be to examine how a lot the CEO is paid.

Basic Public Possession

With a 31% possession, most people, largely comprising of particular person traders, have some extent of sway over Daimler Truck Holding. This dimension of possession, whereas appreciable, is probably not sufficient to alter firm coverage if the choice will not be in sync with different massive shareholders.

Personal Firm Possession

Evidently Personal Firms personal 13%, of the Daimler Truck Holding inventory. It may be price wanting deeper into this. If associated events, akin to insiders, have an curiosity in one in every of these personal corporations, that ought to be disclosed within the annual report. Personal corporations may have a strategic curiosity within the firm.

Public Firm Possession

It seems to us that public corporations personal 30% of Daimler Truck Holding. We will not make certain however it’s fairly potential it is a strategic stake. The companies could also be comparable, or work collectively.

Subsequent Steps:

I discover it very attention-grabbing to take a look at who precisely owns an organization. However to actually achieve perception, we have to contemplate different info, too. For instance, we have found 1 warning signal for Daimler Truck Holding that you have to be conscious of earlier than investing right here.

However finally it’s the future, not the previous, that may decide how properly the house owners of this enterprise will do. Subsequently we expect it advisable to try this free report displaying whether or not analysts are predicting a brighter future.

NB: Figures on this article are calculated utilizing knowledge from the final twelve months, which seek advice from the 12-month interval ending on the final date of the month the monetary assertion is dated. This is probably not in keeping with full 12 months annual report figures.

Valuation is advanced, however we’re serving to make it easy.

Discover out whether or not Daimler Truck Holding is probably over or undervalued by testing our complete evaluation, which incorporates truthful worth estimates, dangers and warnings, dividends, insider transactions and monetary well being.

View the Free Evaluation

Have suggestions on this text? Involved concerning the content material? Get in contact with us instantly. Alternatively, electronic mail editorial-team (at) simplywallst.com.

This text by Merely Wall St is common in nature. We offer commentary based mostly on historic knowledge and analyst forecasts solely utilizing an unbiased methodology and our articles will not be meant to be monetary recommendation. It doesn’t represent a advice to purchase or promote any inventory, and doesn’t take account of your targets, or your monetary state of affairs. We purpose to convey you long-term centered evaluation pushed by basic knowledge. Notice that our evaluation could not issue within the newest price-sensitive firm bulletins or qualitative materials. Merely Wall St has no place in any shares talked about.