Declining Stock and Solid Fundamentals: Is The Market Wrong About Daimler Truck Holding AG ETR:DTG?

It is easy to overlook Daimler Truck Holdings (ETR:DTG) with its stock down 7.7% in the past week. But a closer inspection of its financials might make you reconsider. It is worth considering because fundamentals are often the driving force behind long-term market outcomes. We will be focusing on ROE of Daimler Truck Holding.

ROE (return on equity) is a key indicator of how well a company’s capital is being used by its management. It measures the profitability of a company’s equity capital in relation to it.

Check out our latest analysis of Daimler Truck Holdings

How to Calculate Return on Equity

The formula for equity return is:

Return on Equity = Net Profit (from continuing operations) ÷ Shareholders’ Equity

Based on the above formula, Daimler Truck Holding’s ROE is:

11% = €2.3b ÷ €21b (Based on the trailing twelve months to September 2022).

The company’s earnings in the past year is called its’return’. Another way to think of that is that for every €1 worth of equity, the company was able to earn €0.11 in profit.

ROE is Important for Earnings Growth

We have already learned that ROE is a measure of how efficient a company generates its profits. We now need an evaluation of how much profit the business reinvests or “retains”, which will give us a better idea of its growth potential. Generally speaking, other things being equal, firms with a high return on equity and profit retention, have a higher growth rate than firms that don’t share these attributes.

Side-by-side comparison of Daimler Truck Holdings Earnings Growth and 11% ROE

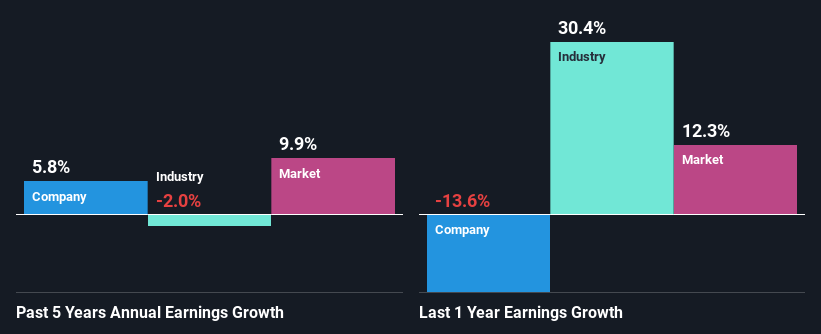

Daimler Truck Holding’s ROE is acceptable. Even if the ROE is compared to the industry average, which is 12%, the company’s ROE seems quite acceptable. This provides context for Daimler Truck Holding’s modest 5.8% net income growth over the past five year.

Given the industry’s decline of 2.5% in earnings over the same period, the net revenue growth of the company is quite impressive.

Earnings growth is a key factor in determining the company’s value. Investors need to find out if the expected earnings growth or lack thereof is already built into the share prices. This helps investors determine if the stock has a bright or dark future. What is DTG worth right now? The Our free research report includes an infographic on intrinsic value that helps you see if DTG is currently being mispriced.

Are Daimler Truck’s Profits Efficiently Reinvested?

Daimler Truck Holding has not paid any dividends to shareholders. We infer that the company is reinvesting all of its profits in order to grow its business.

Conclusion

Overall, we are pleased with Daimler Truck Holdings performance. We are particularly pleased that the company is reinvesting heavily in its business at a high return rate. This has resulted in impressive earnings growth. However, we have seen that the company’s earnings are expected increase in momentum based on current analyst estimates. These analysts’ expectations are based on broad industry expectations or on the company’s fundamentals. Click here to visit our analyst’s forecasts for the company.

Valuation is complicated, but we can help make it simple.

Find out if you qualify Daimler Truck Holding Check out our comprehensive analysis to see if your company is over- or undervalued. Fair value estimates, risks, warnings, dividends and insider transactions, financial health and financial security.

View the Free Analysis

Let us know what you think about this article. Are you concerned about its content? Get in touch Contact us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St has a general nature. Our commentary is based on historical data and analyst projections. We do not intend to provide financial advice. It does not make a recommendation to buy, sell, or trade any stock. It also does not take into account your financial goals or financial situation. We strive to provide you with long-term, focused analysis based on fundamental data. Our analysis may not take into account the most recent price-sensitive company announcements and qualitative material. Simply Wall St does not hold any position in any of the stocks mentioned.