A Observe On Daimler Truck Holding AG’s (ETR:DTG) ROE and Debt To Fairness

The most effective investments we are able to make is in our personal information and ability set. With that in thoughts, this text will work by how we are able to use Return On Fairness (ROE) to raised perceive a enterprise. By means of learning-by-doing, we’ll have a look at ROE to realize a greater understanding of Daimler Truck Holding AG (ETR:DTG).

Return on Fairness or ROE is a take a look at of how successfully an organization is rising its worth and managing buyers’ cash. In different phrases, it’s a profitability ratio which measures the speed of return on the capital supplied by the corporate’s shareholders.

View our newest evaluation for Daimler Truck Holding

How To Calculate Return On Fairness?

The formulation for ROE is:

Return on Fairness = Internet Revenue (from persevering with operations) ÷ Shareholders’ Fairness

So, primarily based on the above formulation, the ROE for Daimler Truck Holding is:

15% = €3.3b ÷ €22b (Based mostly on the trailing twelve months to September 2023).

The ‘return’ is the revenue the enterprise earned over the past 12 months. So, which means for each €1 of its shareholder’s investments, the corporate generates a revenue of €0.15.

Does Daimler Truck Holding Have A Good ROE?

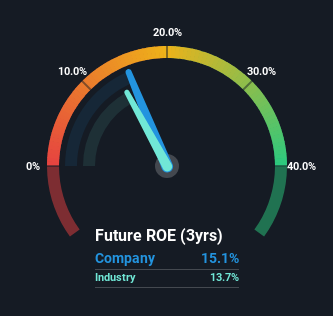

Arguably the best solution to assess firm’s ROE is to check it with the typical in its trade. Nonetheless, this methodology is barely helpful as a tough test, as a result of corporations do differ fairly a bit throughout the identical trade classification. In the event you have a look at the picture beneath, you’ll be able to see Daimler Truck Holding has an identical ROE to the typical within the Equipment trade classification (14%).

So whereas the ROE will not be distinctive, no less than its acceptable. Whereas no less than the ROE will not be decrease than the trade, its nonetheless price checking what position the corporate’s debt performs as excessive debt ranges relative to fairness may additionally make the ROE seem excessive. If an organization takes on an excessive amount of debt, it’s at larger danger of defaulting on curiosity funds. You may see the two dangers we have now recognized for Daimler Truck Holding by visiting our dangers dashboard without spending a dime on our platform right here.

Why You Ought to Think about Debt When Wanting At ROE

Most corporations want cash — from someplace — to develop their income. The money for funding can come from prior 12 months income (retained earnings), issuing new shares, or borrowing. Within the first two instances, the ROE will seize this use of capital to develop. Within the latter case, the debt required for development will increase returns, however won’t influence the shareholders’ fairness. That may make the ROE look higher than if no debt was used.

Combining Daimler Truck Holding’s Debt And Its 15% Return On Fairness

Daimler Truck Holding clearly makes use of a excessive quantity of debt to spice up returns, because it has a debt to fairness ratio of 1.21. Whereas its ROE is fairly respectable, the quantity of debt the corporate is carrying at present will not be preferrred. Traders ought to think twice about how an organization may carry out if it was unable to borrow so simply, as a result of credit score markets do change over time.

Conclusion

Return on fairness is a technique we are able to examine its enterprise high quality of various corporations. An organization that may obtain a excessive return on fairness with out debt might be thought of a top quality enterprise. All else being equal, a better ROE is best.

However when a enterprise is top of the range, the market usually bids it as much as a value that displays this. Revenue development charges, versus the expectations mirrored within the value of the inventory, are a very vital to think about. So that you may need to take a peek at this data-rich interactive graph of forecasts for the corporate.

In fact Daimler Truck Holding is probably not one of the best inventory to purchase. So you could want to see this free assortment of different corporations which have excessive ROE and low debt.

Valuation is complicated, however we’re serving to make it easy.

Discover out whether or not Daimler Truck Holding is probably over or undervalued by trying out our complete evaluation, which incorporates truthful worth estimates, dangers and warnings, dividends, insider transactions and monetary well being.

View the Free Evaluation

Have suggestions on this text? Involved in regards to the content material? Get in contact with us immediately. Alternatively, e-mail editorial-team (at) simplywallst.com.

This text by Merely Wall St is normal in nature. We offer commentary primarily based on historic information and analyst forecasts solely utilizing an unbiased methodology and our articles will not be supposed to be monetary recommendation. It doesn’t represent a advice to purchase or promote any inventory, and doesn’t take account of your targets, or your monetary scenario. We goal to convey you long-term centered evaluation pushed by basic information. Observe that our evaluation could not issue within the newest price-sensitive firm bulletins or qualitative materials. Merely Wall St has no place in any shares talked about.