Improved Earnings Required Earlier than Daimler Truck Holding AG (ETR:DTG) Inventory’s 32% Soar Seems Justified

Daimler Truck Holding AG (ETR:DTG) shares have continued their current momentum with a 32% achieve within the final month alone. Wanting again a bit additional, it is encouraging to see the inventory is up 40% within the final 12 months.

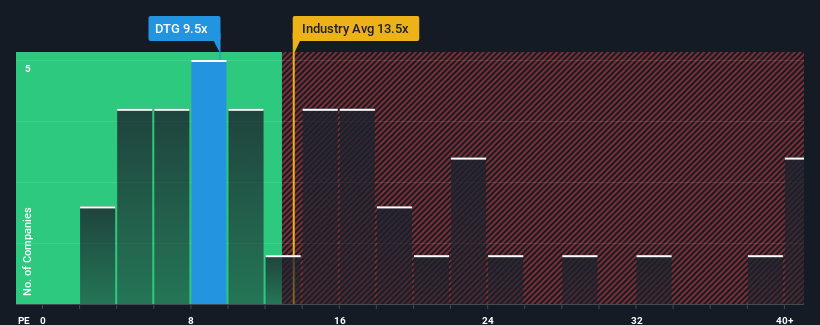

Even after such a big soar in value, Daimler Truck Holding should still be sending bullish indicators in the intervening time with its price-to-earnings (or “P/E”) ratio of 9.5x, since virtually half of all firms in Germany have P/E ratios larger than 16x and even P/E’s increased than 35x should not uncommon. Though, it isn’t sensible to only take the P/E at face worth as there could also be an reason why it is restricted.

With its earnings progress in constructive territory in comparison with the declining earnings of most different firms, Daimler Truck Holding has been doing fairly nicely of late. One chance is that the P/E is low as a result of traders assume the corporate’s earnings are going to fall away like everybody else’s quickly. If you happen to like the corporate, you would be hoping this is not the case in order that you possibly can doubtlessly choose up some inventory whereas it is out of favour.

Try our newest evaluation for Daimler Truck Holding

Need the complete image on analyst estimates for the corporate? Then our free report on Daimler Truck Holding will aid you uncover what’s on the horizon.

What Are Progress Metrics Telling Us About The Low P/E?

Daimler Truck Holding’s P/E ratio could be typical for an organization that is solely anticipated to ship restricted progress, and importantly, carry out worse than the market.

Having a look again first, we see that the corporate grew earnings per share by a formidable 43% final 12 months. Nonetheless, EPS has barely risen in any respect from three years in the past in complete, which isn’t superb. Accordingly, shareholders most likely would not have been overly happy with the unstable medium-term progress charges.

Shifting to the longer term, estimates from the analysts overlaying the corporate recommend earnings ought to develop by 1.7% per 12 months over the following three years. With the market predicted to ship 14% progress each year, the corporate is positioned for a weaker earnings outcome.

In gentle of this, it is comprehensible that Daimler Truck Holding’s P/E sits beneath nearly all of different firms. Apparently many shareholders weren’t comfy holding on whereas the corporate is doubtlessly eyeing a much less affluent future.

The Key Takeaway

Daimler Truck Holding’s inventory may need been given a strong increase, however its P/E definitely hasn’t reached any nice heights. Usually, our desire is to restrict using the price-to-earnings ratio to establishing what the market thinks concerning the total well being of an organization.

As we suspected, our examination of Daimler Truck Holding’s analyst forecasts revealed that its inferior earnings outlook is contributing to its low P/E. At this stage traders really feel the potential for an enchancment in earnings is not nice sufficient to justify a better P/E ratio. Until these circumstances enhance, they may proceed to kind a barrier for the share value round these ranges.

Having stated that, bear in mind Daimler Truck Holding is displaying 2 warning indicators in our funding evaluation, and 1 of these is doubtlessly severe.

If P/E ratios curiosity you, you might want to see this free assortment of different firms with sturdy earnings progress and low P/E ratios.

Valuation is complicated, however we’re serving to make it easy.

Discover out whether or not Daimler Truck Holding is doubtlessly over or undervalued by testing our complete evaluation, which incorporates honest worth estimates, dangers and warnings, dividends, insider transactions and monetary well being.

View the Free Evaluation

Have suggestions on this text? Involved concerning the content material? Get in contact with us immediately. Alternatively, e-mail editorial-team (at) simplywallst.com.

This text by Merely Wall St is basic in nature. We offer commentary based mostly on historic knowledge and analyst forecasts solely utilizing an unbiased methodology and our articles should not supposed to be monetary recommendation. It doesn’t represent a advice to purchase or promote any inventory, and doesn’t take account of your aims, or your monetary scenario. We intention to carry you long-term centered evaluation pushed by elementary knowledge. Be aware that our evaluation could not issue within the newest price-sensitive firm bulletins or qualitative materials. Merely Wall St has no place in any shares talked about.