(DTG) On The My Shares Web page

Longer Time period Buying and selling Plans for DTG

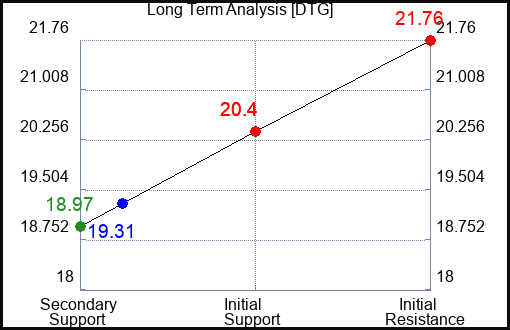

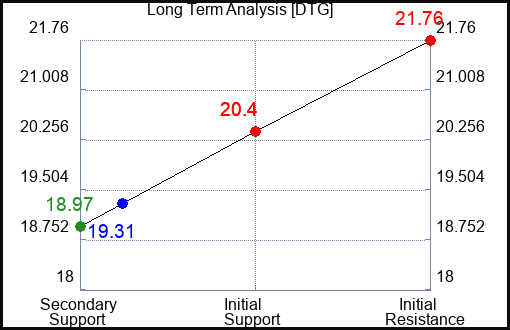

- Purchase DTG barely over 18.97 goal 20.4 cease loss @ 18.92

- Quick DTG just below 20.4, goal 18.97, cease loss @ 20.46

Swing Buying and selling Plans for DTG

- Purchase DTG barely over 20.4, goal 21.76, Cease Loss @ 20.34

- Quick DTG barely close to 20.4, goal 19.07, Cease Loss @ 20.46.

Day Buying and selling Plans for DTG

- Purchase DTG barely over 20.4, goal 21.76, Cease Loss @ 20.35

- Quick DTG barely close to 20.4, goal 19.13, Cease Loss @ 20.45.

Actual Time Updates can be found on our Dte Vitality Firm 2021 Collection E 4.375% Junior Subordinated Debentures (DTG) Web page right here: DTG.

DTG Scores for April 20:

| Time period → | Close to | Mid |

Lengthy |

|---|---|---|---|

| Score | Weak | Weak | Impartial |

| P1 | 0 | 0 | 18.97 |

| P2 | 18.67 | 18.49 | 20.4 |

| P3 | 19.13 | 19.07 | 21.76 |

Help and Resistance Plot Chart for DTG

Blue = Present Worth

Crimson= Resistance

Inexperienced = Help

Actual Time Updates for Repeat Institutional Readers:

Directions:

-

Click on the Get Actual Time Updates button under.

-

Within the login immediate, choose forgot username

-

Kind the e-mail you employ for Factset

-

Use the consumer/go you obtain to login

-

You’ll have 24/7 entry to actual time updates.

Click on the Get Actual Time Updates button under.

Within the login immediate, choose forgot username

Kind the e-mail you employ for Factset

Use the consumer/go you obtain to login

You’ll have 24/7 entry to actual time updates.

From then on you’ll be able to simply click on to get the actual time replace everytime you need.

GET REAL TIME UPDATES

Our Market Crash Main Indicator isEvitar Corte.

-

Evitar Corte warned of market crash threat 4 occasions since 2000.

-

It recognized the Web Debacle earlier than it occurred.

-

It recognized the Credit score Disaster earlier than it occurred.

-

It recognized the Corona Crash too.

-

See what Evitar Corte is Saying Now.

Get Notified When our Scores Change:Take a Trial

Buying and selling or Investing in Dte Vitality Firm 2021 Collection E 4.375% Junior Subordinated Debentures (NYSE: DTG) entails an statement of the technicals, each time. This information reveals the present technicals.

Warning:

This can be a static report, the info under was legitimate on the time of the publication, however help and resistance ranges for DTG change over time, so the report ought to be up to date repeatedly. Actual Time updates are supplied to subscribers. Limitless Actual Time Stories.

Subscribers additionally obtain market evaluation, inventory correlation instruments, macroeconomic observations, timing instruments, and safety from market crashes utilizing Evitar Corte.

Directions:

Directions:

The foundations that govern the info on this report are the foundations of Technical Evaluation. For instance, if DTG is testing help purchase indicators floor, and resistance is the goal. Conversely, if resistance is being examined, that may be a signal to manage threat or brief, and help can be the draw back goal accordingly. In every case, the set off level is designed to be each a super place to enter a place (keep away from buying and selling in the course of a buying and selling channel), and it acts as a degree of threat management too.

Swing Trades, Day Trades, and Long run Buying and selling Plans:

This information is refined to distinguish buying and selling plans for Day Buying and selling, Swing Buying and selling, and Lengthy Time period Investing plans for DTG too. All of those are supplied under the Abstract Desk.

Basic Charts for DTG: