Can Daimler Truck Holding AG’s (ETR:DTG) ROE Proceed To Surpass The Business Common?

Top-of-the-line investments we are able to make is in our personal information and talent set. With that in thoughts, this text will work via how we are able to use Return On Fairness (ROE) to higher perceive a enterprise. By the use of learning-by-doing, we’ll take a look at ROE to realize a greater understanding of Daimler Truck Holding AG (ETR:DTG).

ROE or return on fairness is a great tool to evaluate how successfully an organization can generate returns on the funding it obtained from its shareholders. Briefly, ROE reveals the revenue every greenback generates with respect to its shareholder investments.

Try our newest evaluation for Daimler Truck Holding

How Is ROE Calculated?

ROE may be calculated through the use of the method:

Return on Fairness = Web Revenue (from persevering with operations) ÷ Shareholders’ Fairness

So, based mostly on the above method, the ROE for Daimler Truck Holding is:

17% = €3.8b ÷ €22b (Based mostly on the trailing twelve months to June 2024).

The ‘return’ is the yearly revenue. One other approach to think about that’s that for each €1 value of fairness, the corporate was in a position to earn €0.17 in revenue.

Does Daimler Truck Holding Have A Good ROE?

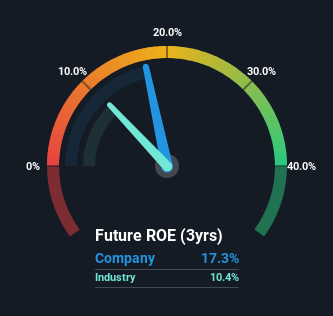

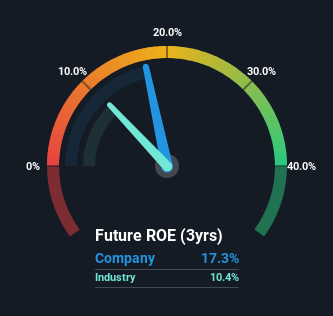

By evaluating an organization’s ROE with its trade common, we are able to get a fast measure of how good it’s. Nonetheless, this technique is barely helpful as a tough verify, as a result of corporations do differ fairly a bit throughout the identical trade classification. As you’ll be able to see within the graphic under, Daimler Truck Holding has the next ROE than the common (10%) within the Equipment trade.

That is clearly a constructive. With that stated, a excessive ROE would not all the time point out excessive profitability. Apart from modifications in internet revenue, a excessive ROE may also be the result of excessive debt relative to fairness, which signifies threat. To know the two dangers we have now recognized for Daimler Truck Holding go to our dangers dashboard totally free.

How Does Debt Influence Return On Fairness?

Just about all corporations want cash to spend money on the enterprise, to develop income. The money for funding can come from prior 12 months income (retained earnings), issuing new shares, or borrowing. Within the case of the primary and second choices, the ROE will replicate this use of money, for development. Within the latter case, the usage of debt will enhance the returns, however is not going to change the fairness. Thus the usage of debt can enhance ROE, albeit together with further threat within the case of stormy climate, metaphorically talking.

Combining Daimler Truck Holding’s Debt And Its 17% Return On Fairness

Daimler Truck Holding does use a excessive quantity of debt to extend returns. It has a debt to fairness ratio of 1.33. Whereas its ROE is fairly respectable, the quantity of debt the corporate is carrying at the moment just isn’t perfect. Traders ought to consider carefully about how an organization may carry out if it was unable to borrow so simply, as a result of credit score markets do change over time.

Conclusion

Return on fairness is a helpful indicator of the flexibility of a enterprise to generate income and return them to shareholders. In our books, the very best high quality corporations have excessive return on fairness, regardless of low debt. If two corporations have across the identical stage of debt to fairness, and one has the next ROE, I might usually choose the one with larger ROE.

However when a enterprise is top of the range, the market usually bids it as much as a value that displays this. It is very important think about different components, reminiscent of future revenue development — and the way a lot funding is required going ahead. So I feel it might be value checking this free report on analyst forecasts for the corporate.

After all, you may discover a implausible funding by wanting elsewhere. So take a peek at this free listing of fascinating corporations.

New: Handle All Your Inventory Portfolios in One Place

We have created the final portfolio companion for inventory buyers, and it is free.

• Join a vast variety of Portfolios and see your complete in a single foreign money

• Be alerted to new Warning Indicators or Dangers by way of e-mail or cell

• Monitor the Truthful Worth of your shares

Strive a Demo Portfolio for Free

Have suggestions on this text? Involved concerning the content material? Get in contact with us straight. Alternatively, e-mail editorial-team (at) simplywallst.com.

This text by Merely Wall St is normal in nature. We offer commentary based mostly on historic knowledge and analyst forecasts solely utilizing an unbiased methodology and our articles will not be meant to be monetary recommendation. It doesn’t represent a suggestion to purchase or promote any inventory, and doesn’t take account of your targets, or your monetary scenario. We goal to carry you long-term targeted evaluation pushed by elementary knowledge. Notice that our evaluation might not issue within the newest price-sensitive firm bulletins or qualitative materials. Merely Wall St has no place in any shares talked about.