Capital Allocation Trends At Daimler Truck Holding (ETR:DTG) Aren’t Ideal

There are often underlying trends that can help us identify potential multi-baggers. In a perfect world we would like to see more capital invested in the business, and that the returns on that capital are increasing. These types of businesses are compounding machines. This means that they reinvest their earnings at ever-higher returns. However, we did find that the average return on investment for these types of businesses was 12%. Daimler Truck Holding (ETR.DTG) It didn’t seem to meet all of these criteria.

What is Return on Capital Employed (ROCE), and How Does It Work?

ROCE is a method that measures the return (pre-tax profit) of capital invested in a company’s business. This formula is used to calculate Daimler Truck Holding’s return.

Return on Capital Employed = Earnings Before Interest and Tax (EBIT) ÷ (Total Assets – Current Liabilities)

0.063 = €2.9b ÷ (€65b – €20b) Based on the trailing twelve month period ending in September 2022.

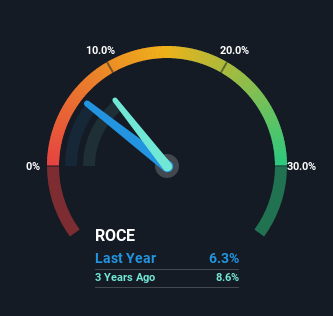

So, Daimler Truck Holdings has a ROCE of 6.3%. That’s a poor return and underperforms the industry average of 8.8%.

View our most recent analysis on Daimler Truck Holding

We have shown Daimler Truck Holding’s ROCE in relation to its performance. However, the future is undoubtedly more important. You can see our forecasts for the future if you want to know what analysts are predicting. Free report for Daimler Truck Holding.

The Trend Of ROCE

The trend isn’t great in terms of Daimler Truck Holding’s historical ROCE movements. ROCE has dropped from 8.6% to 8.6% over three years. It could be that the company is investing in growth and the increased revenue and assets have led to a short-term decrease in ROCE. If the increased capital generates additional profits, shareholders and the business will reap the benefits in the long-term.

Similar to this, Daimler Truck Holding decreased its current liabilities by 30% of total assets. This could be linked to the decline in ROCE. Additionally, this could reduce some aspects of risk for the business since the company’s suppliers and short-term lenders are now funding less of its operations. Some might argue that this reduces the company’s ability to generate ROCE because it is now financing more operations with its own money.

The Bottom Line on Daimler Truck Holdings ROCE

Although returns on capital have declined in the short-term, we are encouraged by the fact that both revenue and capital employed have increased for Daimler Truck Holding. These trends have not appeared to have affected returns, as the stock’s total return has been mostly flat in the last year. Therefore, we recommend that you research this stock to find out more about the business fundamentals.

Another thing to note: We have identified 1 warning sign Daimler Truck Holding should be an integral part of your investment.

Daimler Truck Holding may not be earning the best return, but this is what you should see. Free List of companies that have solid balance sheets and high returns on equity.

Let us know what you think about this article. Are you concerned about the content? Get in touch Get in touch with us. Alternatively, email editorial-team (at) simplywallst.com.

This article is by Simply Wall St. It is general in nature. Our commentary is based on historical data and analyst projections. We do not intend to provide financial advice. This analysis does not represent a recommendation to purchase or sell any stock and does not consider your financial situation or objectives. We are committed to providing you with long-term focused analysis that is based on fundamental data. Our analysis may not take into account the most recent price-sensitive company announcements and qualitative material. Simply Wall St does not hold any position in any of the stocks mentioned.

Participate in a Paid User Research Session

You’ll receive a Amazon Gift Card – US$30 Spend an hour helping us to create better investing tools for individual investors like you. Sign up