Daimler Truck Holding (ETR:DTG) May Have The Makings Of A Multi-Bagger

In the event you’re on the lookout for a multi-bagger, there’s a couple of issues to maintain a watch out for. Firstly, we’ll need to see a confirmed return on capital employed (ROCE) that’s rising, and secondly, an increasing base of capital employed. This reveals us that it is a compounding machine, in a position to frequently reinvest its earnings again into the enterprise and generate increased returns. So on that word, Daimler Truck Holding (ETR:DTG) appears fairly promising with reference to its developments of return on capital.

Understanding Return On Capital Employed (ROCE)

If you have not labored with ROCE earlier than, it measures the ‘return’ (pre-tax revenue) an organization generates from capital employed in its enterprise. To calculate this metric for Daimler Truck Holding, that is the method:

Return on Capital Employed = Earnings Earlier than Curiosity and Tax (EBIT) ÷ (Complete Belongings – Present Liabilities)

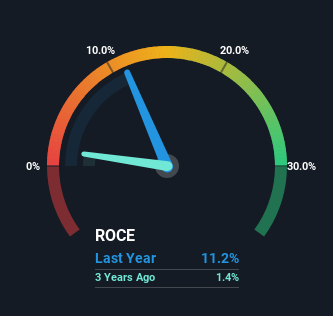

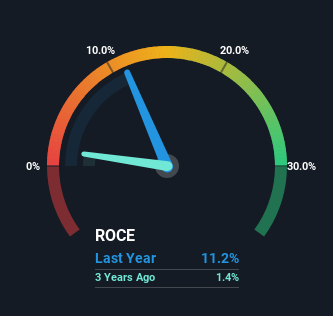

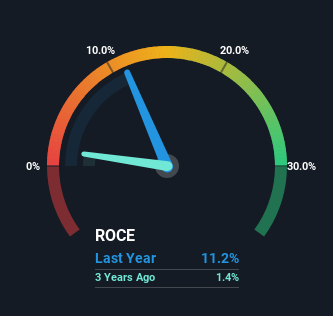

0.11 = €5.4b ÷ (€71b – €23b) (Primarily based on the trailing twelve months to December 2023).

Due to this fact, Daimler Truck Holding has an ROCE of 11%. By itself that is a standard return on capital and it is according to the trade’s common returns of 11%.

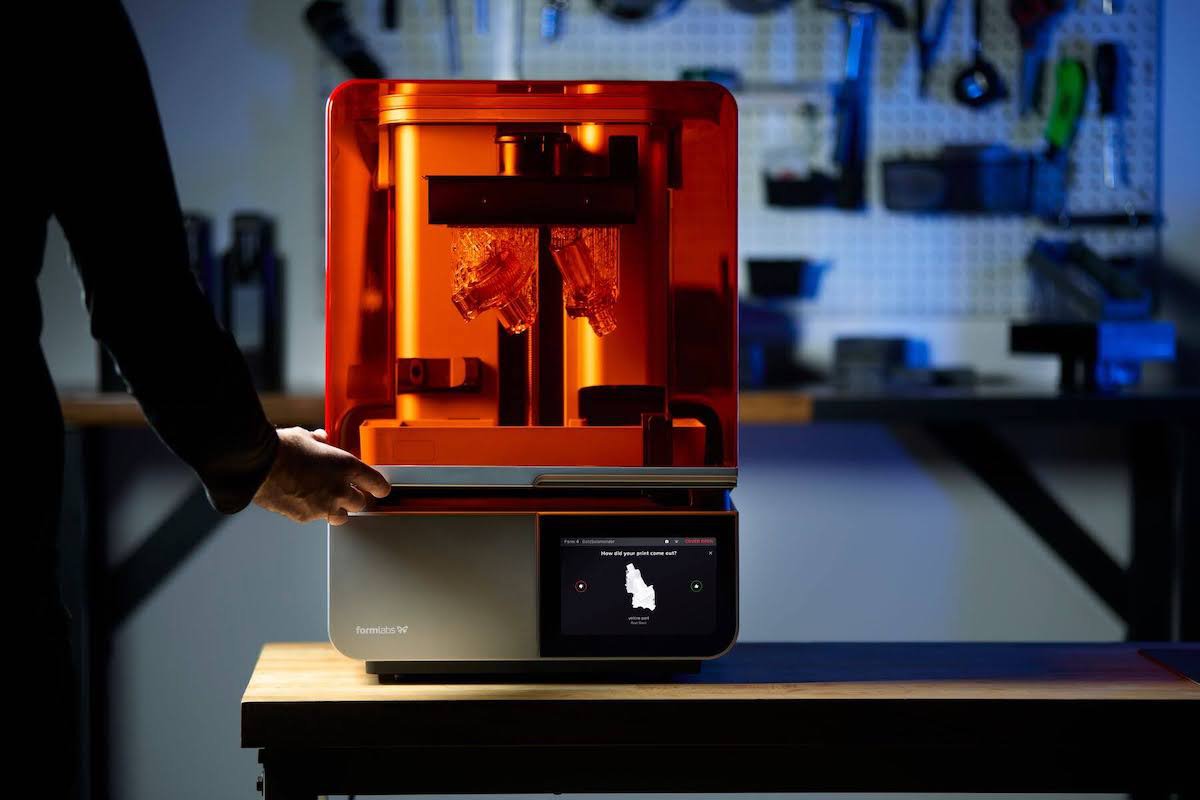

Try our newest evaluation for Daimler Truck Holding

Above you possibly can see how the present ROCE for Daimler Truck Holding compares to its prior returns on capital, however there’s solely a lot you possibly can inform from the previous. In the event you’re , you possibly can view the analysts predictions in our free analyst report for Daimler Truck Holding .

So How Is Daimler Truck Holding’s ROCE Trending?

The developments we have seen at Daimler Truck Holding are fairly reassuring. The numbers present that within the final 5 years, the returns generated on capital employed have grown significantly to 11%. Mainly the enterprise is incomes extra per greenback of capital invested and along with that, 65% extra capital is being employed now too. This will point out that there is loads of alternatives to take a position capital internally and at ever increased charges, a mixture that is widespread amongst multi-baggers.

In Conclusion…

All in all, it is terrific to see that Daimler Truck Holding is reaping the rewards from prior investments and is rising its capital base. And traders appear to anticipate extra of this going ahead, for the reason that inventory has rewarded shareholders with a 54% return over the past yr. In mild of that, we expect it is price wanting additional into this inventory as a result of if Daimler Truck Holding can preserve these developments up, it might have a brilliant future forward.

One remaining word, it is best to be taught in regards to the 2 warning indicators we have noticed with Daimler Truck Holding (together with 1 which is critical) .

If you wish to seek for strong firms with nice earnings, take a look at this free listing of firms with good stability sheets and spectacular returns on fairness.

Have suggestions on this text? Involved in regards to the content material? Get in contact with us straight. Alternatively, e mail editorial-team (at) simplywallst.com.

This text by Merely Wall St is basic in nature. We offer commentary primarily based on historic information and analyst forecasts solely utilizing an unbiased methodology and our articles aren’t supposed to be monetary recommendation. It doesn’t represent a advice to purchase or promote any inventory, and doesn’t take account of your aims, or your monetary scenario. We goal to deliver you long-term targeted evaluation pushed by elementary information. Be aware that our evaluation might not issue within the newest price-sensitive firm bulletins or qualitative materials. Merely Wall St has no place in any shares talked about.