Industrial 3D Printer Shipments Undergo Whereas Desktop Continues to Soar

It’s no secret that monetary markets the world over had a difficult 12 months final 12 months. Inflation and excessive rates of interest have sparked fears for a recession, as even the Worldwide Financial Fund famous that insurance policies should be applied to stop a crash. That is equally the case for 3D printing, although it appears it has hit sure elements of the market tougher than others. Certainly, a brand new report from CONTEXT has proven that industrial 3D printer shipments have considerably slowed, nevertheless entry-level printer gross sales proceed to growth, displaying probably the place we may proceed to see progress in 2024.

2023 was undoubtedly a difficult 12 months within the additive manufacturing world. A slew of failed mergers, mediocre earnings and inventory market woes induced concern, although many of those have been seemingly overstated, with many anticipating the market to bounce again this 12 months. That being mentioned, this report has proven that, particularly within the realm of business 3D printers, there’s some no less than some foundation for concern as it could be time to adapt to the market’s wants.

A Decline in Industrial 3D Printer Shipments

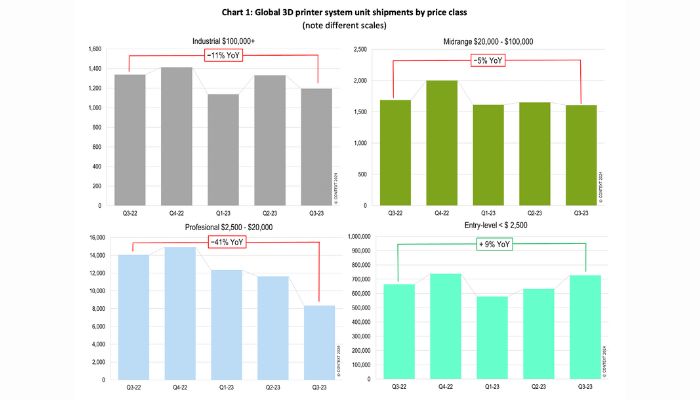

First, it’s necessary to notice the completely different classes of printers included on this newest report and the way they’re categorized. CONTEXT identifies 4 separate teams: industrial ($100K+ 3D printers), midrange ($20,000–100,000), skilled ($2,500–20,000) and entry-level (3D printers underneath $2,500). Within the report, these have been then tracked by gross sales as a way to decide 12 months on 12 months (YoY) progress.

What they discovered does appear to go towards a lot of the logic presently dominating in additive manufacturing. Even if an increasing number of producers are creating in the direction of higher-priced skilled options with extra fascinating options, curiosity from customers appears extra geared in the direction of entry-level fashions. Certainly, the entry-level printer market appears to be the one one who grew in Q3 2023.

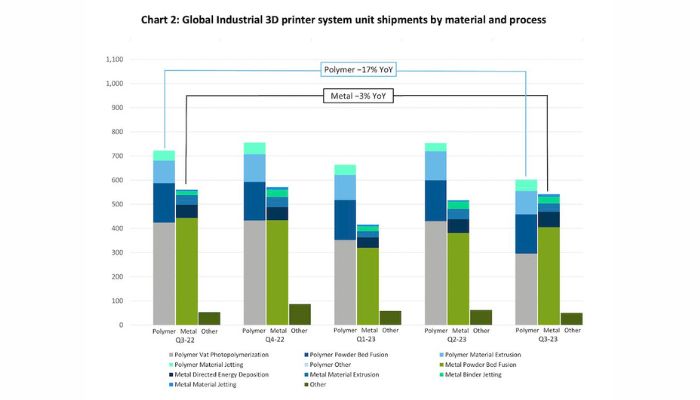

For industrial 3D printer shipments, the polymer phase was hit tougher than metallic (picture credit: CONTEXT)

Extra concretely, the report discovered that for industrial programs, international shipments dropped -11% in Q3, with the distinction particularly stark for polymer options: polymer printer shipments dropped -17% whereas metallic 3D printer shipments solely went down -3%. Although they do observe that the low numbers for polymers appeared to be associated to the notably weak efficiency of vat photopolymerization printers, that are the most important class of business polymer 3D printers.

On the identical time, within the metallic sector, powder mattress fusion shortfalls dragged down the class whereas bigger build-volume, multi-laser powder mattress fusion programs and different applied sciences boosted revenues. This was additionally helped by elevated numbers of Chinese language firms transferring into the sector, with promising outcomes. DED printers as nicely noticed vital progress, firms like Meltio specifically have been seen to be main the cost.

Midrange printer shipments additionally fell -5%, although have been helped by robust shipments of low-end PBF programs, just like the Fuse 1 from Formlabs, and home shipments in China, particularly from UnionTech. With out UnionTech specifically, 3D printer shipments would have been down -17% in response to CONTEXT, with market leaders Stratasys, 3D Methods and Markforged performing notably poorly. Though this was nonetheless nothing in comparison with printers within the skilled worth class. That is the place we noticed the most important downward pattern as 3D printer gross sales dropped -40%, probably because of customers turning in the direction of cheaper options even when they have been lower-performing.

Information from CONTEXT reveals that every one gross sales in 3D printer classes, together with industrial, besides entry-level declined from earlier years (picture credit: CONTEXT)

What Does This Imply?

Whereas this may increasingly look bleak, what’s optimistic nevertheless is that entry-level programs have seen vital progress: a 9% improve in shipments in Q3. Although this comes at a price, particularly from cannibalization of gross sales from skilled 3D printers, it reveals that the market remains to be robust. This has been emphasised particularly by the expansion of firms like Bambu Lab and Elegoo whereas Creality continues to dominate that phase of the market.

Nonetheless, maybe, this does counsel {that a} change in technique is required for the AM market as customers appear happier to stay with cheaper extra fundamental machines moderately than dearer fashions with all of the bells and whistles. Regardless, it is going to be fascinating to see because the 12 months goes on what main 3D printing firms will select to do. Maybe the often-overlooked entry-level class will see a resurgence from extra established 3D printer producers. And additive manufacturing clearly nonetheless has worth for a lot of industries. You possibly can be taught extra HERE.

What do you consider the decline in industrial 3D printer shipments whereas desktop 3D printers appear to be on the rise? Do you suppose this can be a pattern that can proceed over the course of 2024? Tell us in a remark beneath or on our LinkedIn, Fb, and Twitter pages! Don’t overlook to enroll in our free weekly E-newsletter right here, the newest 3D printing information straight to your inbox! You may as well discover all our movies on our YouTube channel.