Is Daimler Truck Holding AG’s (ETR:DTG) Current Inventory Efficiency Tethered To Its Sturdy Fundamentals?

Daimler Truck Holding’s (ETR:DTG) inventory is up by a substantial 22% over the previous three months. On condition that the market rewards robust financials within the long-term, we surprise if that’s the case on this occasion. Significantly, we can be taking note of Daimler Truck Holding’s ROE at present.

ROE or return on fairness is a great tool to evaluate how successfully an organization can generate returns on the funding it acquired from its shareholders. In less complicated phrases, it measures the profitability of an organization in relation to shareholder’s fairness.

Our evaluation signifies that DTG is probably undervalued!

How To Calculate Return On Fairness?

Return on fairness might be calculated by utilizing the system:

Return on Fairness = Internet Revenue (from persevering with operations) ÷ Shareholders’ Fairness

So, based mostly on the above system, the ROE for Daimler Truck Holding is:

8.1% = €1.6b ÷ €19b (Primarily based on the trailing twelve months to June 2022).

The ‘return’ is the revenue the enterprise earned over the past yr. One strategy to conceptualize that is that for every €1 of shareholders’ capital it has, the corporate made €0.08 in revenue.

What Is The Relationship Between ROE And Earnings Development?

We’ve got already established that ROE serves as an environment friendly profit-generating gauge for a corporation’s future earnings. Relying on how a lot of those earnings the corporate reinvests or “retains”, and the way successfully it does so, we’re then capable of assess an organization’s earnings development potential. Assuming all else is equal, firms which have each a better return on fairness and better revenue retention are normally those which have a better development fee when in comparison with firms that do not have the identical options.

Daimler Truck Holding’s Earnings Development And eight.1% ROE

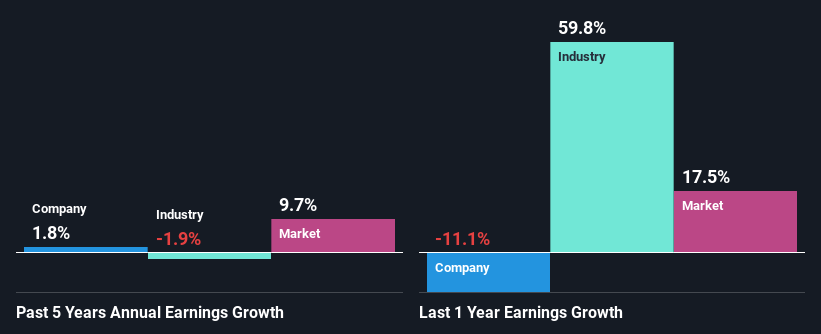

At first look, Daimler Truck Holding appears to have a good ROE. Even so, in comparison with the typical business ROE of 12%, we aren’t very excited. Moreover, the flat earnings seen by Daimler Truck Holding over the previous 5 years would not paint a really shiny image. To not neglect, the corporate does have a good ROE to start with, simply that it’s decrease than the business common. So there could be different causes for the flat earnings development. These embody low earnings retention or poor capital allocation.

Subsequent, on evaluating with the business internet revenue development, we discovered that Daimler Truck Holding’s development determine is a bit higher than the business which has been shrinking at a fee of 1.9% in the identical interval.

Earnings development is a vital metric to contemplate when valuing a inventory. The investor ought to attempt to set up if the anticipated development or decline in earnings, whichever the case could also be, is priced in. Doing so will assist them set up if the inventory’s future appears to be like promising or ominous. Is DTG pretty valued? This infographic on the corporate’s intrinsic worth has every part you want to know.

Is Daimler Truck Holding Effectively Re-investing Its Income?

Daimler Truck Holding would not pay any dividend, which means that probably all of its earnings are being reinvested within the enterprise. Nonetheless, this does not clarify why the corporate hasn’t seen any development. It appears to be like like there could be another causes to elucidate the shortage in that respect. For instance, the enterprise might be in decline.

Abstract

In complete, we’re fairly proud of Daimler Truck Holding’s efficiency. Specifically, it is nice to see that the corporate has seen vital development in its earnings backed by a decent ROE and a excessive reinvestment fee. With that mentioned, the newest business analyst forecasts reveal that the corporate’s earnings are anticipated to speed up. To know extra in regards to the firm’s future earnings development forecasts check out this free report on analyst forecasts for the corporate to seek out out extra.

Valuation is complicated, however we’re serving to make it easy.

Discover out whether or not Daimler Truck Holding is probably over or undervalued by trying out our complete evaluation, which incorporates truthful worth estimates, dangers and warnings, dividends, insider transactions and monetary well being.

View the Free Evaluation

Have suggestions on this text? Involved in regards to the content material? Get in contact with us instantly. Alternatively, electronic mail editorial-team (at) simplywallst.com.

This text by Merely Wall St is common in nature. We offer commentary based mostly on historic information and analyst forecasts solely utilizing an unbiased methodology and our articles will not be supposed to be monetary recommendation. It doesn’t represent a advice to purchase or promote any inventory, and doesn’t take account of your aims, or your monetary state of affairs. We purpose to deliver you long-term targeted evaluation pushed by basic information. Be aware that our evaluation could not issue within the newest price-sensitive firm bulletins or qualitative materials. Merely Wall St has no place in any shares talked about.