Daimler Truck Holdings (ETR : DTG) Slowing Return Rates Leave Little Room For Excitement

If you are not sure where to begin when searching for the next multibagger, you should be on the lookout for a few key trends. In an ideal world, we would love to see a business invest more capital into their business. The returns they earn from this capital should also be increasing. This is an indication that the company is reinvesting their profits at a higher rate of return. This is why we briefly looked at Daimler Truck Holding’s (ETR:DTG). ROCE trend. We were very happy with what we observed.

What is Return on Capital Employed?

For those that don’t already know, ROCE measures the return on capital (profit) of a business. This is the formula to calculate this metric at Daimler Truck Holding:

Return on Capital Employed = Earnings Before Interest and Tax (EBIT) ÷ (Total Assets – Current Liabilities)

0.10 = €4.8b ÷ (€69b – €22b) (Based on the twelve-month trailing period to June 2023).

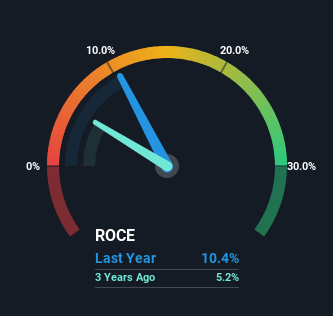

Therefore, Daimler Truck Holding is a ROCE of 10%. This is a normal return on investment, and it’s about the 11% generated in the Machinery industry.

Check out our latest Daimler Truck Holding analysis

In the chart above, we have compared Daimler Truck Holding’s prior ROCE with its prior performance. But the future is perhaps more important. You can find the latest forecasts by the analysts who cover Daimler Truck Holding. free.

What can we learn from Daimler Truck Holdings ROCE Trends?

The returns on capital have been good, but they haven’t changed much. The company has consistently made 10% over the last four-year period, and capital employed in the business has increased by 48% during that time. Daimler Truck Holding’s consistent earnings of 10% are a comforting fact. These returns might not seem exciting but they can be very rewarding over time.

The Key Takeaway

Daimler Truck Holding’s ability to reinvest consistently at respectable rates is the most important thing to remember. It is no surprise, then, that shareholders who held on to their shares over the past 12 months have seen a respectable 11 percent return. We believe that even though the stock is more “expensive”, the fundamentals are still strong enough to warrant further investigation.

We’ve identified some of the most common risks that virtually all companies face. Daimler Truck Holding warning signs There are two types of concern. What you should know

Check out why Daimler Truck Holding does not earn the highest returns. Free List of companies with solid balance sheets that have high returns on capital.

Valuation can be complex, but our team makes it simple.

Find out if you qualify Daimler Truck Holding Check out our comprehensive analysis to see if your home is overvalued or undervalued. Dividends and insider transactions, fair value estimates and warnings.

View the Free Analysis

Have feedback about this article? Are you concerned about the content of this article? Get in touch Contact us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St has a general nature. Our articles do not provide financial advice. They are based on historical data, analyst forecasts and unbiased methods. It is not a recommendation to purchase or sell any stocks, and it does not consider your financial or personal goals. We strive to provide you with long-term analysis based on fundamental data. Please be aware that our analyses may not include the latest qualitative material or announcements by companies. Simply Wall St does not hold any of the stocks mentioned.